Interest rate rise: How will it affect you?

Posted by siteadmin on Friday 3rd of November 2017

It’s taken more than 10 years, but it’s finally happened.

The Bank of England has decided to increase interest rates with the Monetary Policy Committee (MPC) voting by 7-2 to increase base rate from 0.25% to 0.5%, principally in response to inflation hitting 3%.

The rise was modest, not that you would have thought so from the acres of coverage it got, and only takes rates back to where they were in August last year. However, with inflation stubbornly above target, it is probably a sign of things to come.

As the hysteria dies down, it’s ...

Should you invest in Buy to Let when you retire?

Posted by siteadmin on Wednesday 18th of October 2017

Should you invest in Buy to Let when you retire?

New research from Retirement Advantage shows that 13% of over-50s are considering investing in Buy to Let when they finish working. Resulting in a potential surge of 1.3 million new landlords across the UK.

Why the sudden interest in property?

22% of 50-somethings who are adding property investment into their retirement plans are doings so because they already have experience as a successful landlord. Meanwhile, almost one in five (18%) have an underlying interest in property and believe ...

Retirement: Why saving too much, in the wrong place, could cost you thousands

Posted by siteadmin on Monday 16th of October 2017

It may seem like the ultimate first world problem.

However, saving too much into a pension could cost you tens of thousands of pounds in unnecessary tax.

We all need to prepare for retirement. In fact, according to the Government, 45% of us aren’t putting enough away (Source: The Pensions Advisory Service). However, those that are taking their retirement planning seriously are in danger of falling foul of an often-overlooked allowance, that limits the amount that can be paid into a pension.

As with most things in the financial world, k...

Debunking the Critical Illness Cover myth

Posted by siteadmin on Monday 16th of October 2017

Do Critical Illness Cover plans pay out when you make a claim?

The media loves a story involving refusal to pay out on insurance claims. Those cases are highlighted to cause a reaction and as a result, the public perception of Critical Illness Cover has been distorted. Fortunately, the media’s portrayal of insurance not paying out is more myth than fact.

In 2016, statistics provided by the Association of British insurers (ABI) showed that a record 15,646 Critical Illness Cover claims were successful last year.

What is Critical Illness ...

Should you give money away to reduce your Inheritance Tax (IHT) bill?

Posted by siteadmin on Monday 16th of October 2017

Inheritance Tax (IHT) is a controversial issue which leaves many people wondering how they can reduce the amount that will be lost to the government when they die.

The good news is that IHT only affects estates worth more than £325,000. The bad news is that it is easier to breach this threshold than you might think. Your home alone could be worth more than that amount.

It may be possible to reduce your estate’s worth and avoid paying high amounts of IHT by gifting amounts to family, friends and charity before you die. Plus, seeing the im...

Bank of Mum and Dad still doing brisk business

Posted by siteadmin on Monday 16th of October 2017

With hardly any queues, convenient opening hours and a great location, the Bank of Mum and Dad is the preferred financial institution of many.

Membership is limited (it helps if they’re actually your parents!), but new research reveals it is expanding (Source: Prudential). And often-lenient repayment conditions are part and parcel; nearly 60% of loans are partly or fully written off.

For many people, help from the Bank of Mum and Dad is the only way they can afford things such as education or a home. But, exactly how affordable is it to ...

Retirement: Do you have enough?

Posted by siteadmin on Monday 16th of October 2017

How much do you need for retirement?

It’s not an easy question to answer, for a number of reasons. For one thing, it depends entirely on how you want to spend your retirement.

If you don’t know how much you need, new research from Retirement Advantage suggests that you probably don’t have enough.

So, how much are people falling short by? And more importantly, what can they do about it?

Shortfall

On average, over-50s say that they need a gross income of £1,435 per month to live on in retirement. However, a pension pot with the UK avera...

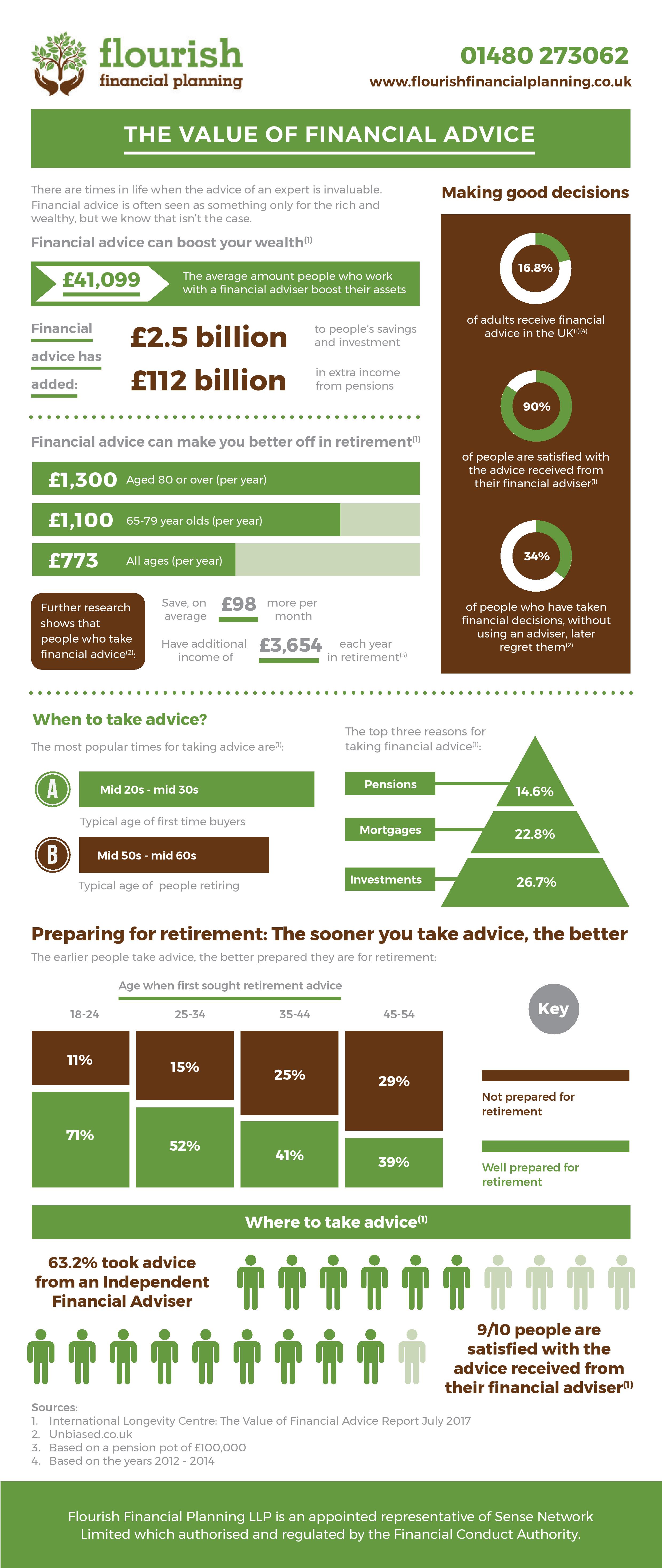

The value of financial advice

Posted by siteadmin on Wednesday 30th of August 2017

Confusion over pension contribution cap resolved

Posted by siteadmin on Friday 28th of July 2017

By Rob Barron

The Government has moved to resolve the confusion over the amount some people can pay into their pension. Although, not everyone will be happy with the news.

Announced in the Budget earlier this year, the change proposed a cut in the amount some people could pay in to their pension. Known as the Money Purchase Annual Allowance (MPAA), it caps the amount some people, who have already drawn money from their pension under the new Pension Freedom rules, can subsequently contribute. The Government proposed a cut from £10,000 to ...

70 per cent of under 30s predicted to have a pension shortfall – are you one of them?

Posted by siteadmin on Thursday 20th of July 2017

By Rob Barron

New research from the Scottish Widows suggests that whilst auto-enrolment has been a success, under 30s are not putting enough away to save for their future.

For the uninitiated, auto-enrolment was introduced as part of the Pension Act in 2008, and means that an employer must enrol staff into a workplace pension if they fit a range of criteria, including the following:

- Over the age of 22

- Earn more than £10,000

Once enrolled, employees have a month to decide whether to stay in, or opt out. If they choose to stay in t...