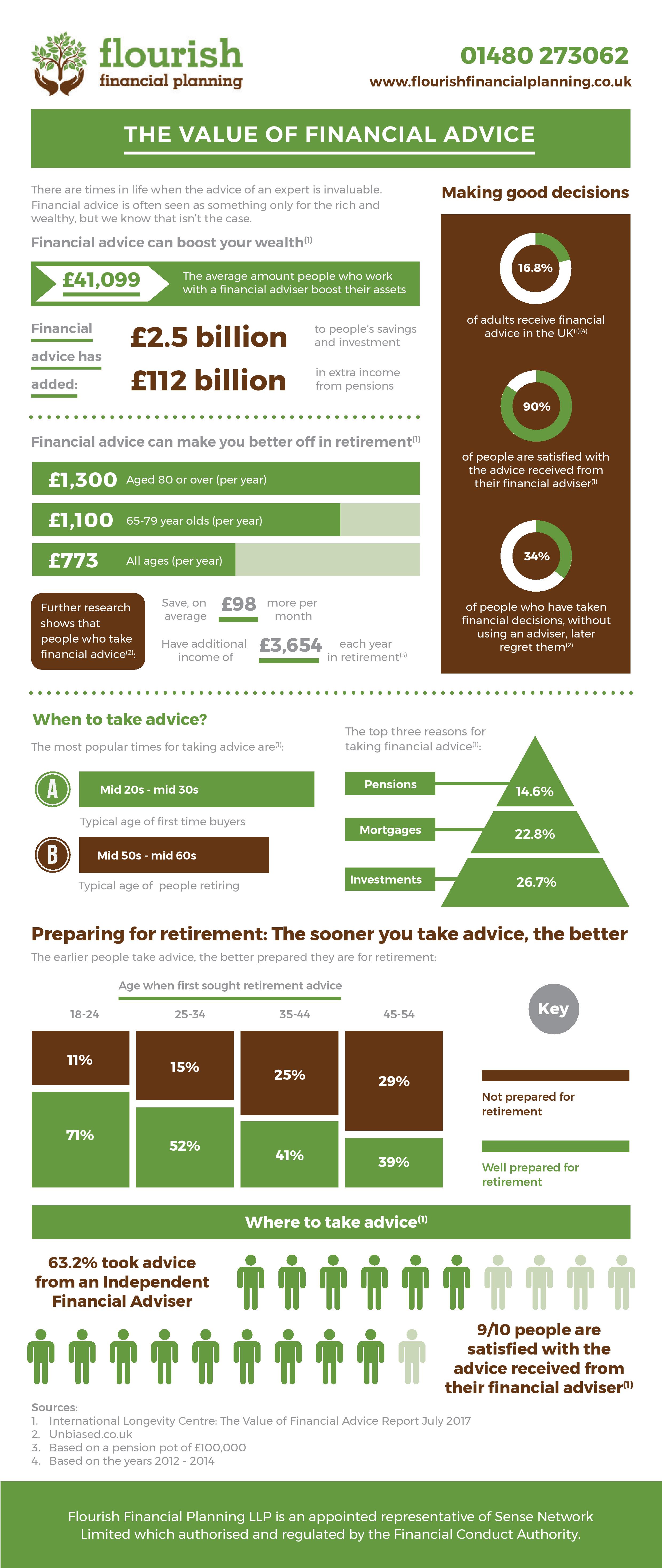

The value of financial advice

Posted by siteadmin on Wednesday 30th of August 2017.

Archive

-

2025

-

October

- Guide: Everything you need to know about the State Pension

- Why you should look on the bright side of life

- Investment market update: September 2025

- How a cashflow model can turn retirement anxiety into excitement

- Why stock market volatility can trigger financial bias

- Phasing into retirement: The flexible options you might consider

- What footballer Kevin Keegan tells us about retirement planning

-

July

- Investment market update: June 2025

- 5 powerful Warren Buffett lessons that could benefit ordinary investors

- Explained: How Dividend Tax works and when you pay it

- 5 valuable reasons to consult a solicitor when writing your will

- The age you can access your pension may rise. Could it affect your retirement?

- How to prepare your loved ones for the “great wealth transfer”

-

April

- Revealed: The best city break destinations for this summer

- Investment market update: March 2025

- 4 reasons to remain calm amid market volatility and uncertainty

- Why you should make registering a Lasting Power of Attorney a priority

- Half of adults reconsidering their retirement plans ahead of 2027 Inheritance Tax changes

- 5 strategies that could help you avoid running out of money in retirement

-

January

- 5 practical tasks that could help you get more out of your pension in 2025

- How you could take advantage of falling interest rates

- Investment market update: December 2024

- 5 useful allowances and exemptions that will reset at the end of the tax year

- Research: Financial stability could be the key to retirement happiness

- The compelling benefits of building a tailored financial plan

-

-

2024

-

October

- Your Autumn Budget update – the key news from the chancellor’s statement

- 2 valuable types of financial protection to consider if you have a family

- Investment market update: September 2024

- Why inflation solutions should remain part of your long-term financial plan

- Climbing annuity rates could boost your retirement income

- Inheritance Tax: How does the UK compare internationally?

- Could a financial plan give you the confidence to retire sooner?

-

July

- The value of financial planning: How it could help you achieve your aspirations

- The fantastic benefits of basing your financial plan on happiness

- How “time travelling” as part of your financial plan could help you secure your goals

- What is cholesterol and how does it affect your health?

- How to effectively protect your identity and your finances from criminals

- Higher-rate taxpayers: Beware of the 60% tax trap

-

April

- Investment market update: March 2024

- Could you face an unexpected bill now the Capital Gains Tax allowance has halved?

- The announcement of the new UK ISA marks 25 years of tax-efficient savings

- More retirees may need to consider tax liability as State Pension nears the Personal Allowance

- Running out of money tops retirement concerns, but financial planning could bring peace of mind

- Retirement planning: Bringing together your goals and finances

-

March

-

January

- Investment market update: December 2023

- The feel-good news stories you might have missed in 2023

- Why general elections in 2024 could lead to volatile investment markets

- The pros and cons of choosing a living legacy over leaving an inheritance

- Retirement planning: Should you consider a phased retirement?

- The 3 essential pension decisions you should review to avoid becoming a “triple defaulter”

-

-

2023

-

November

-

October

- Investment market update: September 2023

- Financial security is the most important retirement goal for 9 in 10 Brits

- 5 useful conversations to have this Talk Money Week

- HMRC collects a record amount in Capital Gains Tax. Here’s how you could manage your liability

- 5 common mistakes when writing a will that a solicitor could help you avoid

- 3 valuable reasons your financial reviews are important

-

July

- Investment market update: June 2023

- The 3 types of tax you need to understand before investing in buy-to-let

- 5 excellent reasons families use trusts

- Savers celebrate rising interest rates, but it could mean an unexpected tax charge

- 7 common but potentially harmful Inheritance Tax myths debunked

- Retirees, don’t overlook the surprising risk of underspending in retirement

-

April

- Investment market update: March 2023

- Forget the new year, spring is the perfect time to set new goals

- Financial planning as a couple could boost your finances, but almost 2 in 5 admit to “financial infidelity”

- 51% of adults don’t have a will. Here’s why it should be a priority task

- 4 valuable ways a financial planner can help you tackle “overwhelming” pension information

- Estate planning: Do you need to include Inheritance Tax?

-

March

-

January

- 3 key autumn statement changes you need to be aware of for the new tax year

- Have you used your pension Annual Allowance? Here’s why you should review it before the tax year ends

- 6 feel-good news stories from 2022 to make you smile

- Investment market update: December 2022

- Revealed: The key to happiness in retirement is focusing on experiences

- 3.3 million pre-retirees have started a phased retirement. Here’s what you need to know about managing your finances

-

-

2022

-

October

- Investment market update: September 2022

- More people are turning to equity release to boost their income. Find out why here

- What wishes should you set out when creating a trust to pass on wealth?

- Living legacies are on the rise. Here’s what you need to know about them

- The UK ranks 19th globally for retirement security. Here’s why and what you can do

- Before you increase pension withdrawals as the cost of living rises, here’s what you need to consider

- Why it’s important to remain calm amid continuing economic uncertainty

-

August

-

July

- Inflation: What happened the last time the cost of living was rising this rapidly?

- Investment market update: June 2022

- How delaying retirement could help you maintain your standard of living as inflation rises

- Should you voluntarily pay National Insurance contributions to boost your State Pension?

- 5 compelling reasons why you should share a financial planner with your family

- Modern retirees are increasing their spending in later years, and it could affect your financial security

-

April

- The useful guide to reaching your retirement goals

- Investment market update: March 2022

- Why it pays to use your 2022/23 ISA allowance right now

- “Midlifers” are hit by time and financial pressures. Financial planning can help balance your priorities

- Do you think you’d never be fooled by a scammer after watching the Tinder Swindler? Here are the tricks fraudsters use

- HMRC refunds £42 million in overpaid tax to pensioners. Have you paid too much?

- Why good retirement planning is about more than your pension and money

-

February

-

January

- Your complete 2021/22 end of tax year guide

- 7 different ways you can leave gifts in your will

- Investment market update: December 2021

- 2 allowances to use before the end of the tax year to make your retirement more comfortable

- 3 personal finance risks in 2022 and what you can do about them

- 8 things to do if you’re retiring in 2022

- 5 steps that could provide financial security for your partner if you pass away

-

-

2021

-

October

- Everything you need to know about the 2021 Autumn Budget

- Investment market update: September 2021

- 7 signs of stress and how to combat them to improve your wellbeing

- 7 steps to take when you receive an inheritance to make the most of it

- 5 reasons you need to write a will (and keep it up to date)

- Why you need to complete an expression of wishes alongside your will

- Are you taking enough risk with your pension? Being too cautious could mean lower returns

-

September

- Investment market update: August 2021

- After 2 “once in a lifetime” economic events in 12 years, how can you protect your assets?

- Should you use savings to help children pay for university?

- 83% of parents are saving for their children in cash, but it might not be a good idea

- 3 things to think about if you want to relocate in retirement

- When can you access your pension? It might be further away than you think

- Guide: Leaving an inheritance vs gifting during your lifetime

-

August

- The guide to later-life planning and care

- Investment market update: June 2021

- Everything you need to know about financially supporting children through university

- “It won’t pay out” and other financial protection myths busted

- Can you still earn an income from investments in 2021?

- Are Premium Bonds and other prize draws a good option for your savings?

- Is £26,000 the secret to a happy retirement?

-

June

-

April

- Employee benefits that self-employed workers miss out on, and how to bridge the gap

- What does “rebalancing” your portfolio mean and why is it important?

- Why opening a pension for a child before they start school can unlock powerful growth

- 3 reasons to make social care part of your retirement plan

- Pension Lifetime Allowance is frozen until 2026: Will it mean your retirement tax bill soars?

- How the tax freezes announced in the Budget could leave you worse off

-

March

-

January

- The 2020/21 end of the tax year guide

- Is health insurance something you should consider?

- £1.9 billion gifted to younger generations during the pandemic

- Financial health check: How do you score?

- Are Premium Bonds a good place for your savings?

- Beware of pension trap when accessing your pension before retirement

- The importance of taking stock of your pension withdrawals after market volatility

-

-

2020

-

December

-

November

-

October

- Guide to ESG investing

- Accessing a Child Trust Fund: What are the options?

- Financial planning week: 10 steps to take before New Year

- How a will can help you reduce Inheritance Tax

- 5 steps the self-employed should take to prepare for retirement

- Should you take a tax-free lump sum from your pension?

- Pension age rises to 57: What does it mean?

-

September

-

July

-

April

- There are 4 different types of ISA available. Your guide to choosing the right one for you

- Bank of England interest rate cut: What does it mean for finances?

- What does coronavirus mean for my pension and retirement?

- 2020/21 tax year: Exemptions and allowances

- Your complete guide to the 2020 Budget

- Small business owner? Here are the measures in place to help you through the pandemic

-

January

- DIY money management could cost you in the long run

- 5 things to keep in mind when you review your investments in 2020

- 6 things the mini-bond scandal can teach investors

- How have VCTs been used in the last 25 years?

- The tapered annual allowance: What you need to know

- How do UK pensions compare to the rest of the world?

-

-

2019

-

October

- What to consider when investing for a child’s future

- How financial planning goes beyond simple calculations

- What is compound interest and how does it affect you?

- Bonds: How do they fit into your investment portfolio?

- 7 things to review when looking at your pension

- Is it worth paying into a pension if you’re approaching retirement?

-

July

-

April

- Could the Japanese tradition of Kanreki help with your retirement planning?

- Protecting your money from inappropriate investment products

- Considering ethics in finance

- Premium Bonds: What are they and should you purchase them?

- The cost of opting out of a Workplace Pension as minimum contributions rise

- Your guide to purchasing an Annuity

-

January

- One million Brits unable to work for more than a month each year

- Does bias affect your financial security?

- What should you consider when weighing up your investment risk profile?

- How to protect your pension income during volatility

- Three things to know about sustainable investment

- Do you know your State Pension age?

- Pension cold calling ban: What does it mean for scams?

-

-

2018

-

October

- Autumn Budget 2018: Were you a winner or a loser?

- Autumn Budget 2018: Everything you need to know

- Have you considered the cost of care in retirement?

- Sustainable investment continues to grow

- Seven questions to ask before you start investing

- Could your retirement income be below minimum wage?

- The cost of university: Parents expecting to pay £17,000

- Making sure your pension lasts a lifetime as withdrawals increase

-

August

-

July

- A guide to Premium Bonds as NS&I announce 1.4 million unclaimed prizes

- Pretirement: Why work during retirement?

- Six reasons to write a will even if you think you have nothing worth inheriting

- 10 signs it’s time to get financial advice

- The digital hurdle preventing retirees from accessing state benefits

- The importance of independent living in later life

- Early days: Upturn in young adults saving for retirement, but millions still lag behind

-

April

- Knowing your goals: How to plan your retirement around the things that matter to you

- Are you in a financially compatible relationship? …And does it matter?

- Four ways Pension Freedoms has changed retirement

- Knowledge is power: Do you know what your pension is worth?

- UK homeowners more financially stable than other countries

-

January

- Seven changes you need to know about in 2018

- 62% of adults don’t understand inflation; here’s our quick explainer

- 2018: A big year for auto-enrolment

- Almost half of millennials feel that advice will benefit their savings

- Pension Freedoms: Ignorance isn’t bliss

- Urgent call from MPs to ban pension scam cold calls

- Seven tips for choosing the right savings account

- The effects of inflation - and how to combat them

-

-

2017

-

November

-

October

- Should you invest in Buy to Let when you retire?

- Retirement: Why saving too much, in the wrong place, could cost you thousands

- Debunking the Critical Illness Cover myth

- Should you give money away to reduce your Inheritance Tax (IHT) bill?

- Bank of Mum and Dad still doing brisk business

- Retirement: Do you have enough?

-

August

-

July

-

June

-

May

-

April

-

-

2016

-

March

-

January

-

-

2015

-

November

-

September

-

You are now departing from the regulatory site of Flourish Financial Planning. Neither Flourish Financial Planning nor Sense is responsible for the accuracy of the infomation contained within the site.