Article by Rob Barron 28/08/15

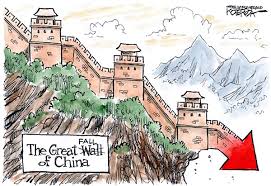

With the "Great Fall of China" prompting dips in Western financial markets and reminding us of the interconnectedness of today's global economy, you might be forgiven for worrying about market drops harming your investment. Instead, however, recent events should serve as a reminder of the importance of taking a long term view.

Easy as it may be to forget when TV screens are full of downward pointing red arrows and sweaty men in their shirtsleeves furrowing their brows, in the long term markets as a whole almost always move upwards. The challenge is having a diverse enough portfolio and the patience to remember that a 'loss' (or indeed a profit) isn't real until you actually come to sell an asset.

There's one big difference between short term and long term movements in markets. Short term swings tend to be driven by human emotion, often in spirals. The more prices drop, the more people worry and sell off investments, and the laws of supply and demand means that prices drop further. The same concept is at play with sudden, seemingly inexplicable booms in prices.

Long term movements are more commonly driven by the underlying value of investments. For example, with shares that's the profits of the business. With bonds, it's the ability of companies to repay their debts. While individual companies may swing either way, it's again a case of looking at the big picture. Fundamentally, business as a whole continues to operate, profit and repay debt, something you can see by the simple fact that consumers continue to be able to shop for their needs and wants.

Short term views and the resulting panic trades have a couple of other drawbacks beyond simply increasing the risk of losing out through poor timing. The more short-term your purchasing and sales outlook is, the more trades you make, and in turn the more of your money is eaten up by fees and taxes. Also, by disposing of assets more quickly, you lose out on associated benefits such as dividends and interest payments.

If you'd like to learn more about how we can help you benefit from taking the long view, particularly with lifelong investments such as pensions, contact us on

contact@ffp-uk.com or visit our website Flourishfinancialplanning.co.uk

Your blog pos

Your blog pos

You are now departing from the regulatory site of Flourish Financial Planning. Neither Flourish Financial Planning nor Sense is responsible for the accuracy of the infomation contained within the site.